Phoenix Real Estate- How much are the closing costs?

The closing costs on your purchase in Arizona is going to vary dependent upon several factors, the biggest of which is whether you pay cash or finance your new property. Another major factor involved is whether we can get a portion or perhaps most of your costs paid by the seller when we negotiate your offer. Some sellers may be willing to give you such a concession while others will not.

The closing costs on your purchase in Arizona is going to vary dependent upon several factors, the biggest of which is whether you pay cash or finance your new property. Another major factor involved is whether we can get a portion or perhaps most of your costs paid by the seller when we negotiate your offer. Some sellers may be willing to give you such a concession while others will not.

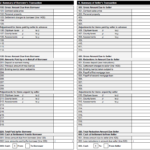

Closing costs may include the following:

HOA fees: Home Owners Associations vary with the fees that they may charge. Most will have a transfer fee of anywhere between $75 -$400. Also, you will be required to pay two months of HOA fees upfront to the HOA.

Escrow fees: The escrow company has a charge for their services similar to how a lawyer does and this amount is typically split in half by buyer and seller unless otherwise stipulated on the offer. They also have a fee for the county recording of the deed, courier charges and other small miscellaneous charges that lawyers back home always seem to have a knack at charging for.

Pro-rations: Just like back home property taxes will be pro-rationed to the moving day as will be the current month of HOA fees.

Financing fees: If you get a mortgage here you will have a number of fees including loan origination fees, ALTA loan policy (kind of like CMHC mortgage insurance policy) to guarantee the loan to the bank, appraisal fees, loan interest pre-paid from date of mortgage funding to your first payment, and associated other processing and application fees. To finance here you can count on double the amount of your closing costs compared to cash.

Inspection charges: Any of the inspections that you may decide to do on the property of choice such as a home inspection or a termite inspection will get added to the closing /settlement statement and included in your total for payment just prior to possession.

So what kind of total should I expect to see for the closing costs?

Closing costs are definitely going to vary but as a simple rule of thumb you can count on the maximum to be between 1%- 1 ½ % of purchase price for a cash sale or about 2 1/2%- 3% of purchase price for a financed sale excluding the possibility of getting some or all covered by the seller as part of a negotiated purchase contract. We’ll get a better idea of the exact $$ amount once we are involved in the negotiations for the home of your choice but it’s good to know the worst case scenario entering in to the purchase forum isn’t it?

When the settlement statement has been prepared by the escrow company they will forward it to us first so that we can go through it item by item to ensure accuracy. Then we’ll forward it up to you for your approval. Next the escrow company forwards it to the sellers for their approval. Once everyone agrees you can wire down the funds required to close directly in to the escrow company’s bank account. You’ll be supplied with the wiring instructions long before this as you’ll need them to send down the initial deposit which in the USA is called Earnest Money.

Here is a PDF explaining Who pays closing costs….buyer or seller.

To view properties for sale or to list your home for sale, please call Laurie at 888-494-8558.